Almost all payroll service providers are designed around businesses and not households. This means different tax forms and tax filings. No household should ever file a Form 941 but many do (incorrectly), because of bad advice provided to them by payroll providers.

We offer the only full service, full electronic household payroll solution designed specifically for the household. From direct deposit to quarterly and annual tax filings, our service offering allows you to pick the specific options that will work for your particular circumstances. Our payroll specialists will help you navigate down the path so that the payroll solution is optimized to your needs.

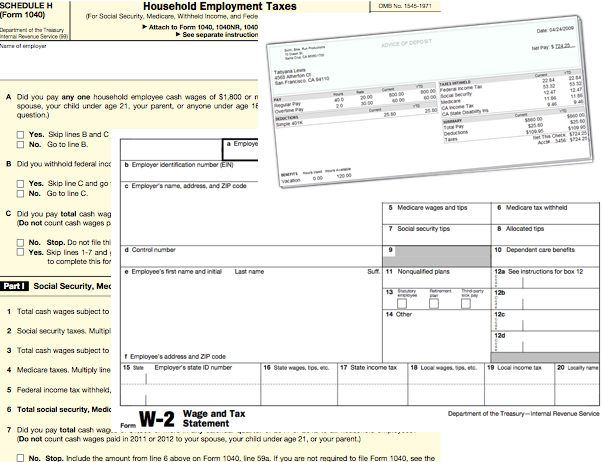

Our lives are complicated and fast moving so all clients are not going to want to be bothered signing and sending paper tax filings off in the mail, especially when it is time sensitive. We handle this process electronically so that you will never have to deal with a late payment or forgetting a filing. We assume this burden and then offer full integration if you are using any personal finance software, such as Intuit Quicken®, QuickBooks® or Microsoft Money®. We also prepare the Schedule H filings for you and we also provide guidance on tax and labor law compliance. None of the competition can offer a comprehensive solution designed for an individual household.

Employing someone is no easy decision, but when you have decided to do so, you should be educated as to the specific state laws. The last thing you want is an issue where you thought you were doing the right thing and find out that it’s wrong. With over twenty-five years of experience, we have the knowledge to answer all of your questions.

Redlig Financial Services Inc. Where Your Family Comes First

Redlig Financial Services Inc. Where Your Family Comes First